Cost Sharing: Deductibles, Copays, and Coinsurance Explained for Medication Costs

Feb, 15 2026

Feb, 15 2026

When you pick up your prescription, do you ever wonder why you paid $40 one month and $120 the next? It’s not because the price of the drug changed - it’s because of how your health insurance handles cost sharing. Deductibles, copays, and coinsurance aren’t just confusing terms thrown at you by insurance companies. They’re real numbers that directly affect how much you pay for your medications - and understanding them can save you hundreds, even thousands, of pounds a year.

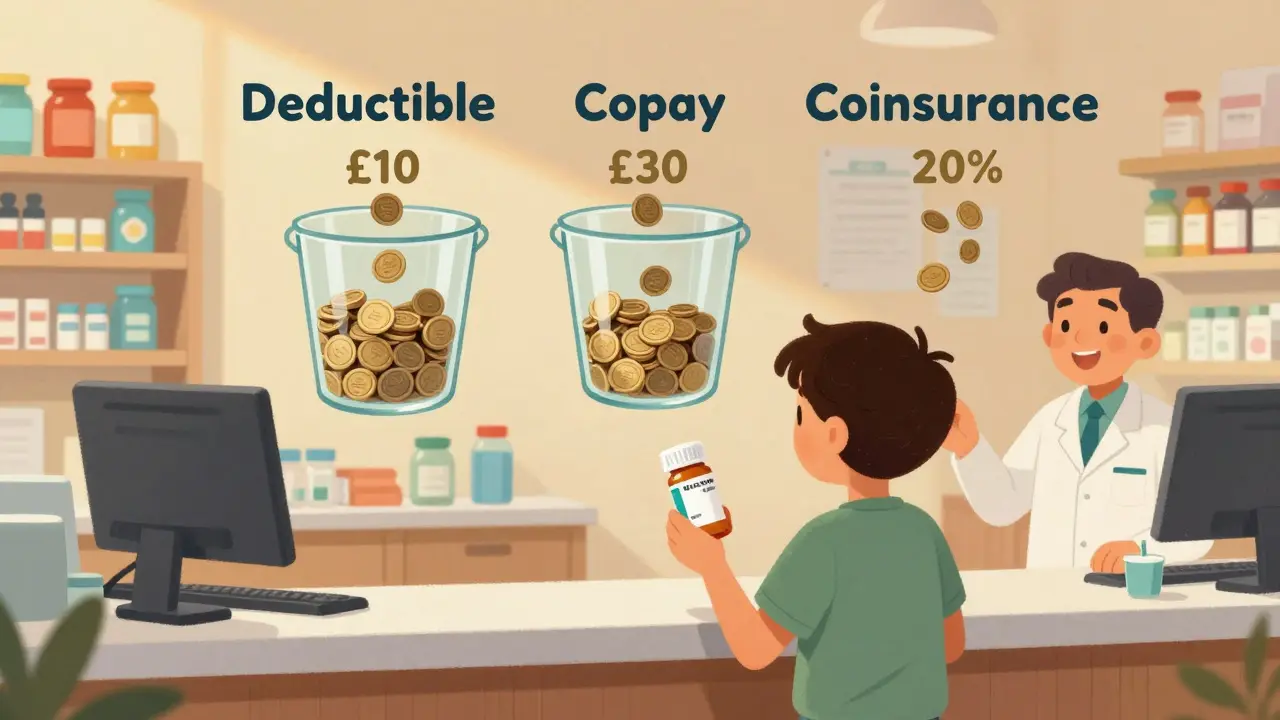

What Exactly Is Cost Sharing?

Cost sharing is the part of your healthcare bill that you pay out of your own pocket. Your insurance doesn’t cover everything. Even if you have a plan, you’re still responsible for a portion of the cost - and that portion depends on three things: your deductible, your copay, and your coinsurance. These three work together to split the cost between you and your insurer. The goal? To keep monthly premiums lower while making sure you don’t overuse care. But for people managing chronic conditions or taking expensive medications, this system can feel like a maze.

Deductible: The First Hurdle

Your deductible is the amount you pay each year before your insurance starts helping with costs. Think of it like a bucket. Every time you pay for a doctor’s visit, lab test, or prescription, that money goes into the bucket. Once the bucket is full - meaning you’ve paid your deductible - your insurance kicks in.

For example, if your plan has a $1,500 deductible, you pay 100% of your medication costs until you’ve spent that much. So if your monthly insulin costs £80, you’ll pay £960 in a year just to meet your deductible. After that, your plan starts paying a share. But here’s the catch: not all medications count toward your deductible the same way. Some plans treat prescriptions differently than doctor visits. Always check your plan’s Summary of Benefits to see which services count.

High-deductible plans (HDHPs) are common - especially in employer-sponsored insurance. In 2023, the average individual deductible was £1,945 (about $2,500). If you’re healthy and rarely take meds, these plans make sense. But if you’re on long-term medication, you’ll hit that deductible fast - and pay more upfront.

Copays: Fixed Fees at the Pharmacy

A copay is a fixed amount you pay each time you get a prescription filled. It doesn’t matter how much the drug costs. You pay £10, £20, or £30 - whatever your plan says - and your insurance covers the rest.

Most plans have different copay tiers based on the type of medication:

- Generic drugs: £10-£15

- Preferred brand-name drugs: £30-£50

- Non-preferred or specialty drugs: £75-£200+

Here’s the key: copays often apply after you meet your deductible - but not always. Some plans require you to pay the full cost of meds until your deductible is met, even if they have a copay. Others let you pay the copay right away, regardless of deductible. This varies by plan. Always ask your insurer: “Do I pay my copay before or after meeting my deductible?”

For someone taking a specialty drug like Humira or Enbrel, a £100 copay every month adds up to £1,200 a year - even after the deductible. That’s why knowing your tier matters. If your plan has a “preferred” list, ask your pharmacist if there’s a cheaper alternative that’s still covered.

Coinsurance: Paying a Percentage

Coinsurance is trickier because it’s not a fixed amount - it’s a percentage. After you meet your deductible, you pay a portion of the cost, and your insurance pays the rest. The most common split is 80/20: your insurer pays 80%, you pay 20%.

Let’s say your insulin costs £150 per month. After meeting your deductible, your coinsurance kicks in. You pay 20% of £150 = £30. Your insurance pays £120. Sounds fair? Until you realize that £150 isn’t the final price. That’s the “allowed amount” - what your insurer has negotiated with the pharmacy. If you go to an out-of-network pharmacy, the allowed amount might be £220. Now you’re paying 20% of £220 = £44. Suddenly, your monthly cost jumped by £14.

Coinsurance is especially important for expensive drugs. A cancer medication costing £5,000 per month? At 20% coinsurance, you pay £1,000. That’s £12,000 a year - and that’s before you hit your out-of-pocket maximum.

Out-of-Pocket Maximum: The Safety Net

This is the most important number on your plan. It’s the most you’ll pay in a year for covered services - including prescriptions. Once you hit it, your insurance pays 100% of all covered costs for the rest of the year.

In 2023, the federal cap was £7,300 for individuals and £14,600 for families (about $9,100 and $18,200). That means if you’re on a £1,200-a-month specialty drug, you’ll hit your max in about six months. After that, your meds are free.

But here’s the catch: only costs that count toward your deductible, copays, and coinsurance are included. Premiums don’t count. And if you go out-of-network, those costs might not count either - or they might count at a lower rate. Always check your plan’s fine print.

How These Three Work Together

Imagine you’re on a plan with:

- £2,000 deductible

- £30 copay for generics

- 30% coinsurance after deductible

- £7,300 out-of-pocket max

Month 1-6: You take a £100 generic drug. You pay £100 each month because you haven’t met your deductible. Total paid: £600.

Month 7: You hit your £2,000 deductible. Now your coinsurance applies. Same drug - £100. You pay 30% = £30. Insurance pays £70.

Month 8-12: You keep paying £30 per month. Total for the year: £600 (deductible) + £300 (coinsurance) = £900.

But if you take a £1,000 specialty drug? After deductible, you pay 30% = £300 per prescription. One prescription pushes you £300 toward your £7,300 max. Two more, and you’re halfway there.

This is why knowing your plan’s structure matters. A £30 copay sounds cheap - until you realize it doesn’t apply until after you’ve paid £2,000.

What’s New in 2026?

Since 2023, things have shifted. The Inflation Reduction Act capped insulin at £25 per month for Medicare patients - a huge relief for diabetics. But if you’re on private insurance, that cap doesn’t apply. Some private insurers have followed suit voluntarily, but not all.

Also, new transparency rules mean insurers must now show you estimated out-of-pocket costs for prescriptions before you fill them - online or via phone. Use it. Ask: “If I fill this today, how much will I pay?”

And remember: preventive care - like annual check-ups or vaccinations - still has no cost sharing. But prescriptions? Not always.

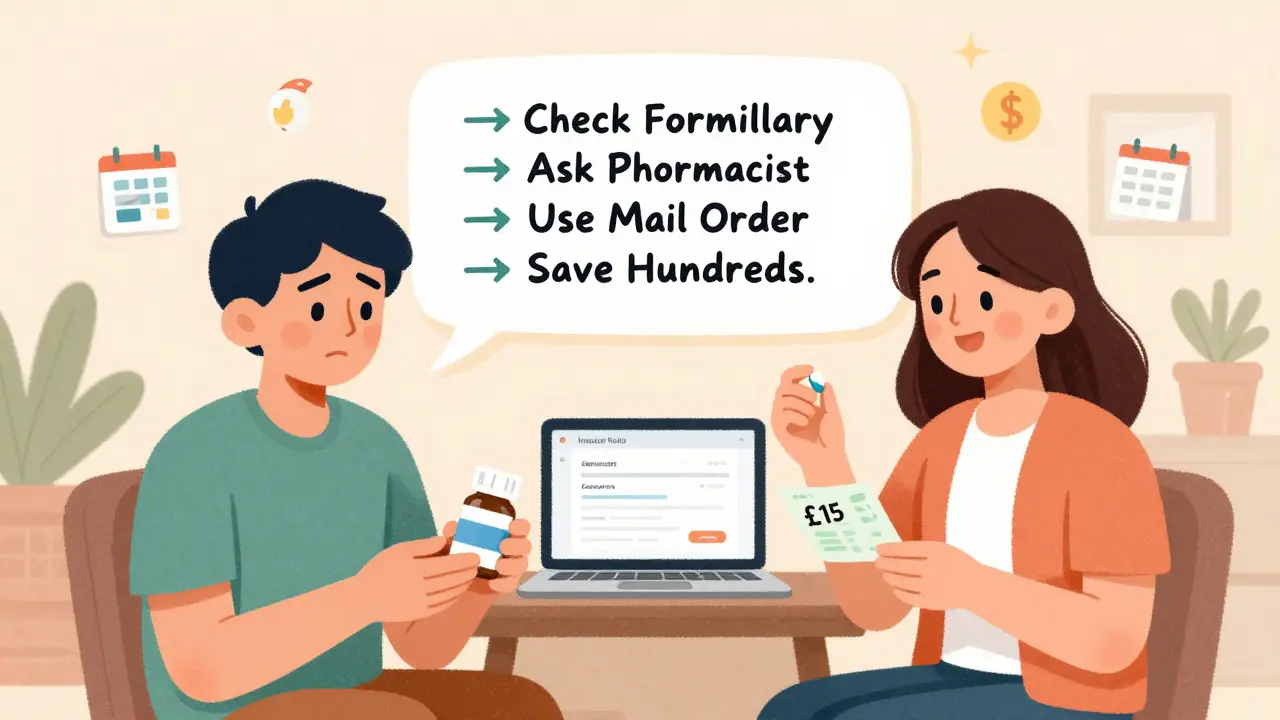

How to Save Money

- Use in-network pharmacies. Out-of-network means higher coinsurance or no coverage at all.

- Ask your doctor if there’s a generic or preferred brand on your plan’s formulary.

- Check if your insurer has a mail-order program - often cheaper for 90-day supplies.

- Use your plan’s cost estimator tool. Most insurers have one online.

- Review your plan’s Summary of Benefits every year. It’s required by law - and it’s written in plain language.

- If you’re on a high-deductible plan, consider an HSA. You can use pre-tax money to pay for meds, even before you meet your deductible.

One person in Bristol told me she switched from a £500/month specialty drug to a generic alternative after checking her plan’s formulary. Her out-of-pocket dropped from £150 to £15. That’s not luck - that’s knowing how cost sharing works.

Common Mistakes

- Thinking your premium counts toward your out-of-pocket max. It doesn’t.

- Assuming a copay applies immediately. Sometimes it doesn’t - until after your deductible.

- Not checking if your pharmacy is in-network. A quick Google search can save you hundreds.

- Ignoring the difference between “allowed amount” and “retail price.” Your insurance negotiates prices. You’re only responsible for a percentage of that negotiated rate.

Many people get hit with surprise bills because they didn’t check these basics. Don’t be one of them.

Do copays count toward my deductible?

It depends on your plan. Some plans count copays toward your deductible - others don’t. Most high-deductible plans require you to pay the full cost of prescriptions until you meet the deductible, even if you have a copay. Always check your plan’s Summary of Benefits or call your insurer directly.

What if I can’t afford my medication after meeting my deductible?

Many drug manufacturers offer patient assistance programs - especially for expensive medications. Nonprofits like the Patient Advocate Foundation and NeedyMeds can help you find discounts or free drugs. Also, ask your pharmacist about 30-day vs. 90-day supplies - sometimes buying more upfront lowers your per-month cost. And if you’re on Medicare, insulin is capped at £25 per month.

Why does my coinsurance change depending on where I fill my prescription?

Your insurance company negotiates prices with different pharmacies. If you use an out-of-network pharmacy, the “allowed amount” they’ve agreed on might be higher - or they might not cover it at all. That means you pay a percentage of a larger number, or pay the full retail price. Always use in-network pharmacies unless it’s an emergency.

Do preventive medications like birth control or vaccines count toward my deductible?

No. Under the Affordable Care Act, most preventive services - including birth control, vaccines, and annual check-ups - must be covered at 100% with no cost sharing, even if you haven’t met your deductible. But this only applies if the service is prescribed and billed as preventive. If your doctor prescribes a drug for a chronic condition, it may count. Always confirm with your insurer.

Can I change my plan to reduce medication costs?

Yes - during open enrollment (usually November to January), you can switch plans. Look for ones with lower coinsurance for your specific meds, or a lower tier for your drug class. If you have a life change - like a new diagnosis - you may qualify for a special enrollment period. Don’t wait until you’re hit with a £1,000 bill to act.

Final Tip

Don’t just accept your plan as it is. Every year, compare your medications to your plan’s formulary. Ask your pharmacist: “Is there a cheaper alternative that’s covered?” Call your insurer and say: “I take [drug name]. How much will I pay this year?” Write it down. You’ll be surprised how much you can save - and how little you actually need to pay.

PRITAM BIJAPUR

February 17, 2026 AT 09:05Just read this and my brain went from "huh?" to "oh GOD, this makes sense now." 😭

Turns out I’ve been overpaying for my thyroid med for 3 years because I thought copays applied immediately. Nope. Had to hit my $2k deductible first. That’s like $1,200 down the drain. Lesson learned: always read the fine print. Or hire someone to read it for you. 🙃

Dennis Santarinala

February 17, 2026 AT 12:46Wow. Just… wow. This is the clearest breakdown I’ve ever seen. Seriously, someone should turn this into a TikTok series. Or a comic. Or a podcast. It’s that good. 🙌

And yes-I’ve been that person who just shrugged and paid whatever the pharmacy said. No more. I’m calling my insurer tomorrow. Thanks for this.

Haley DeWitt

February 19, 2026 AT 07:38Same!! I just switched to mail-order for my asthma inhaler and saved $80/month. 🤯

Also, I didn’t know preventive meds didn’t count toward deductible-my birth control was free last year, but I thought I was just lucky. Turns out it’s the law. 😊

John Haberstroh

February 19, 2026 AT 08:14Let me tell you about the time I tried to fill my diabetes med at CVS and got billed $400. I asked why. They said, "Oh, you’re out-of-network." I didn’t even know my pharmacy wasn’t in-network. Turns out I’d been using the one across the street because it was "convenient."

Now I drive 20 minutes to the in-network one. My monthly bill dropped from $320 to $65. And I’ve got a new appreciation for the word "negotiated."

Also, I now keep a spreadsheet. It’s weirdly satisfying.

Logan Hawker

February 19, 2026 AT 22:58Look, I get it. You’re all so concerned about "cost-sharing." But have you considered that maybe… the system is designed this way? Insurance companies aren’t villains-they’re just playing the game. And you? You’re the sucker who keeps buying into the myth that "understanding" will save you.

Meanwhile, Big Pharma’s making bank, and you’re over here comparing copay tiers like it’s a fantasy football draft. 🤡

James Lloyd

February 20, 2026 AT 04:47There’s a critical point missing here: the difference between formulary tiers and step therapy. Many plans require you to try cheaper drugs first-even if they’re less effective for you. If your doctor doesn’t document medical necessity, you’re stuck paying full price for the drug you need.

Also: HSA eligibility isn’t just about high-deductible plans. You need to be enrolled in one. And yes, you can use HSA funds for OTC meds now. Check IRS Pub 502. It’s legit.

Digital Raju Yadav

February 20, 2026 AT 07:21Why are Americans so obsessed with "saving money" on meds? In India, we get insulin for ₹15 a vial. $0.18. We don’t need 12 paragraphs explaining coinsurance.

You built a whole system around profit. Now you’re surprised people can’t afford it?

Stop pretending this is about "health." It’s about capitalism. And you’re all just rearranging deck chairs.

Carrie Schluckbier

February 21, 2026 AT 05:06Did you know? The government is secretly colluding with Big Pharma to keep prices high. The "Inflation Reduction Act"? A distraction. They only capped insulin for Medicare because seniors vote. Private insurers? Still gouging. And guess who’s monitoring this? The same people who wrote the rules.

I’ve seen the documents. The data is buried in PDFs. You think you’re "saving"? You’re being played. Always.

guy greenfeld

February 21, 2026 AT 19:17It’s not about deductibles. It’s about the ontological crisis of modern healthcare.

You’re told you’re "responsible" for your costs… but you’re never given the tools to understand them. The system is designed to induce learned helplessness.

And yet… you still click "enroll" every year. Why?

Because you’ve been conditioned to believe choice exists.

It doesn’t.

And that’s the real tragedy.

Adam Short

February 22, 2026 AT 06:29British here. We don’t have this nonsense. NHS gives meds for £9.35. If you can’t afford it? You don’t pay. Simple.

Why does America turn medicine into a puzzle? Why do you need a spreadsheet just to get your blood pressure pills?

It’s not a system. It’s a horror show.

Sam Pearlman

February 22, 2026 AT 08:16Okay but have you tried asking for a cash price? I paid $12 for my metformin last week-cash. No insurance. No formulary. Just walked in and said, "What’s your lowest price?"

Pharmacy said, "Here’s $12."

Turns out the insurance price was $87. I’m not even mad. I’m just… confused. Why does anyone use insurance for generics? 🤔

Steph Carr

February 23, 2026 AT 19:24So… you’re telling me I’ve been paying $140/month for my antidepressant… because I didn’t know my plan had a "preferred" list?

And that I could’ve switched to a generic that works just as well… for $12?

Oh. My. God.

I just spent $1,680 last year on a drug that could’ve been bought at a gas station for the price of a coffee.

And I thought I was "managing my mental health."

Turns out I was just managing my bank account’s slow, silent suicide. 🤭

Philip Blankenship

February 25, 2026 AT 01:13I’m gonna go deep on this because I’ve been through it. My kid has a rare condition. We’re on a specialty drug that costs $12,000/month. We hit our out-of-pocket max in June. June. Not December. June.

Before that? We were living in fear. Every month, we’d get the bill. $2,400. We’d cry. We’d argue. We’d call the manufacturer. We’d cry again.

Then we hit the max. And suddenly? It’s free. No copay. No coinsurance. Nothing. Just a little envelope from the pharmacy with a thank-you note.

And I realized: the system isn’t broken. It’s designed to break you. Until it doesn’t.

So if you’re on a high-deductible plan? Save every receipt. Track every penny. Know your max. Because when it hits? You’ll be grateful you did.

And if you’re lucky? You’ll get a new appreciation for what "free" really means.

Tony Shuman

February 25, 2026 AT 04:55Yeah, I’m the guy who paid $1,000 for a 30-day supply because I didn’t read the fine print. Then I found out my pharmacy wasn’t in-network. I didn’t even know that was a thing. I thought "pharmacy" was "pharmacy."

Now I have a spreadsheet. A color-coded one. With tabs. And a flowchart. And a checklist. And a backup checklist.

And I still get billed wrong.

So yeah. I’m not proud. But I’m prepared.