Generic Drug User Fees: How FDA Funding Powers Faster Generic Medicine Approvals

Feb, 22 2026

Feb, 22 2026

Every year, Americans fill over 4 billion prescriptions for generic drugs. These are the same medicines as brand-name drugs-same active ingredients, same strength, same safety-but cost a fraction of the price. Behind the scenes, a quiet but powerful system makes this possible: the Generic Drug User Fee Amendments, or GDUFA. This isn’t just a bureaucratic program. It’s the financial engine that keeps the FDA’s generic drug review machine running. Without it, the approval process for life-saving generics would grind to a halt.

What Is GDUFA and Why Does It Matter?

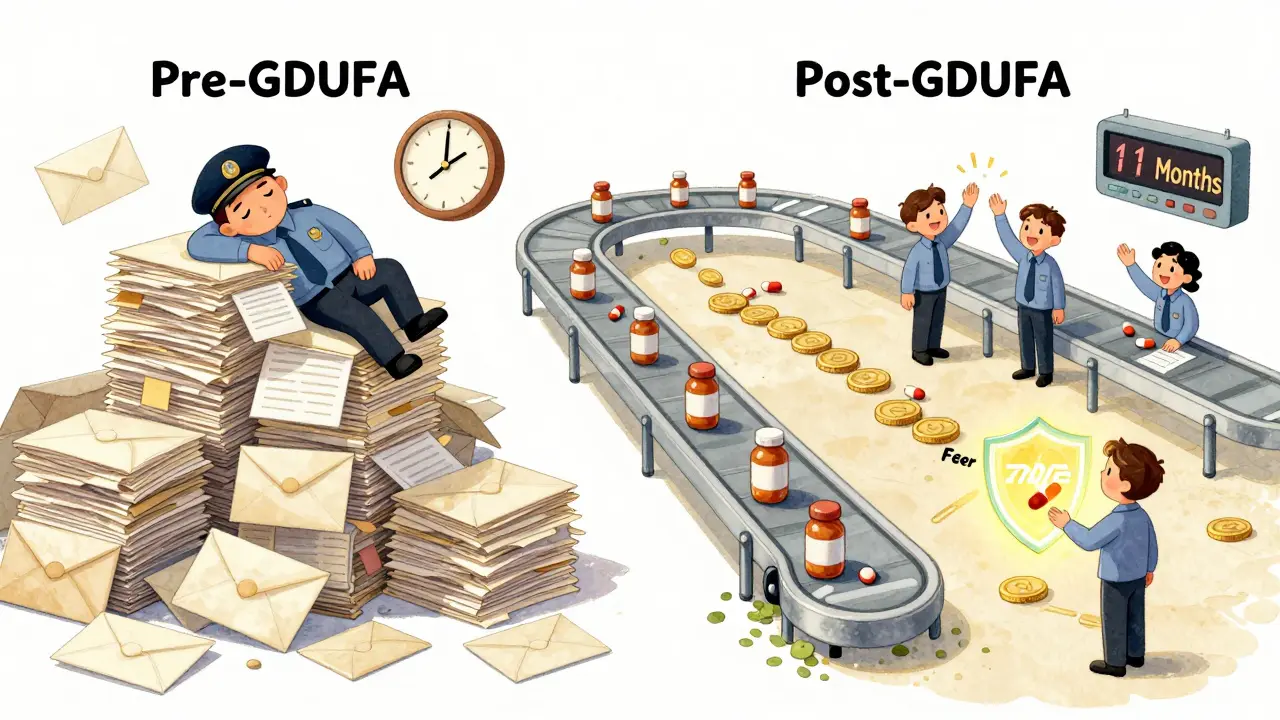

GDUFA was created in 2012 when Congress gave the FDA the legal right to collect fees from companies that make generic drugs. Before GDUFA, the FDA’s generic drug office was underfunded and overwhelmed. Applications piled up. Review times stretched to 30 or even 36 months. Patients waited years for cheaper alternatives to expensive brand drugs. GDUFA changed that.

It works like this: generic drug manufacturers pay fees to the FDA every time they submit an application to sell a generic version of a brand-name drug. These fees don’t guarantee approval. They don’t speed up approval by cutting corners. Instead, they give the FDA the resources to hire more reviewers, improve technology, and set clear timelines. The result? Today, 60% of generic drug applications are reviewed and acted on within 15 months-down from over two years before GDUFA.

This isn’t a gift from industry. It’s a deal. The FDA gets steady funding. The industry gets predictability. Patients get faster access to affordable medicine.

The Four Types of Fees Under GDUFA

GDUFA isn’t one flat fee. It’s a system with four distinct fees, each tied to a different part of the approval process.

- Application fees: Every time a company submits an Abbreviated New Drug Application (ANDA), they pay $124,680 (as of FY 2023). This covers the full review of the drug’s safety, effectiveness, and manufacturing.

- Program fees: Companies with approved generic drugs pay $385,400 annually. This helps fund ongoing oversight and system maintenance.

- Facility fees: If a manufacturing site (for active ingredients or finished pills) is linked to an approved generic drug, it pays $25,850 per year. This ensures the FDA can inspect every facility that makes generic medicine.

- DMF fees: Drug Master Files (DMFs) contain detailed manufacturing info for ingredients. When a DMF is first referenced in an ANDA, the holder pays $25,850. This lets the FDA review the ingredient’s quality before the drug even gets submitted.

These fees are not optional. If a company doesn’t pay, the FDA won’t review their application. And if they miss a payment deadline, their application is put on hold-no exceptions.

How GDUFA Compares to Brand-Name Drug Fees

It’s easy to assume that generic drug fees are just smaller versions of brand-name fees. But the difference is staggering.

The Prescription Drug User Fee Act (PDUFA), which funds reviews for brand-name drugs, charges over $3.4 million per application in FY 2023. That’s more than 27 times the generic drug application fee. Why? Because brand-name drugs require full clinical trials, complex data packages, and years of testing. Generic drugs don’t. They prove they’re the same as the brand-no need to repeat trials.

But here’s the twist: the FDA receives over 1,100 ANDA applications a year, compared to fewer than 70 new brand-name drug applications. So even though each generic fee is tiny, the volume is enormous. GDUFA collects more total money than it did before 2012, but it’s spread across hundreds of companies instead of a handful of big pharma firms.

This means GDUFA’s real power isn’t in the money-it’s in the volume. It lets the FDA handle hundreds of applications at once without collapsing under the load.

Impact on Approval Timelines and Patient Access

Before GDUFA, a generic drug could take over two years just to get reviewed. Today, the median approval time is under 12 months. That’s a game-changer.

When a brand-name drug’s patent expires, the first generic to enter the market often gets six months of exclusive sales. That’s worth hundreds of millions. But if the FDA is slow, that window closes. GDUFA keeps that window open.

Since GDUFA started, generic drug approvals have jumped 22% annually. The FDA met its 90% goal for timely deficiency feedback in 2021. That means companies get clear, specific feedback on why their application was rejected-instead of vague, generic comments. That’s huge. It cuts down on repeated submissions and delays.

And the savings? Over $1.7 trillion in consumer savings since 2012. That’s because generics hit the market faster, and competition drives prices down. One study found that 15% more generics entered the market on time after GDUFA began.

Problems and Criticisms

It’s not perfect.

One big issue: the backlog. Even after over a decade, there are still around 1,500 ANDA applications from before GDUFA that haven’t been reviewed. The FDA has pledged to clear them all by September 2024, but delays from the pandemic and complex submissions have slowed progress.

Small manufacturers are also struggling. The $25,850 facility fee might be a drop in the bucket for Teva or Mylan. But for a small company that runs just one facility, it’s 15% of their entire regulatory budget. In 2022, only 18 small businesses applied for the 75% fee reduction. That’s because the rules are confusing. Many don’t even know they qualify.

And then there’s the gap: over-the-counter (OTC) drugs. GDUFA doesn’t cover them. That’s a $117 billion market. Think pain relievers, antacids, allergy meds. These drugs still rely on outdated rules from the 1970s. Experts are pushing to bring OTCs under GDUFA. If they do, it could add $150-200 million in annual fees and cut review times for these common medicines.

How Companies Navigate the System

Getting GDUFA right takes work. Companies must use the FDA’s electronic system (EUF) to pay fees. Deadlines are strict:

- Program fees: due April 1 each year

- Facility fees: due October 1

- Application and DMF fees: due at submission

Companies also have to track affiliations. If two companies are owned by the same parent, they might be treated as one entity for fee purposes. The FDA’s rules on ownership (50% or more control) are detailed, and mistakes can lead to double fees or missed payments.

Many companies hire regulatory consultants just to handle GDUFA. But the FDA offers help: webinars, fee calculators, and a helpdesk (open 8:30 AM-4:30 PM ET, Monday-Friday). Still, new staff often take 3-6 months to get comfortable with the system.

The Bigger Picture: Why This System Works

GDUFA is a rare win-win. The FDA gets funding without asking Congress for more money. Industry gets faster, clearer reviews. Patients get cheaper drugs sooner.

It’s not about profit. It’s about function. The FDA doesn’t approve drugs because companies pay. They approve them because the drugs meet the same standards as the brand. The fees just make sure there are enough people on the other side of the desk to review them.

The numbers tell the story: 90% of prescriptions in the U.S. are for generics. But only 23% of drug spending goes to them. That’s because GDUFA keeps the pipeline flowing. It’s not flashy. It doesn’t make headlines. But every time someone fills a $5 prescription for a generic pill instead of a $50 brand, GDUFA had a hand in it.

What’s Next? GDUFA III and Beyond

GDUFA was renewed through 2027. But the next phase-GDUFA IV-is already being discussed. Ideas include:

- Adding OTC monograph drugs to the system

- Using real-world data (like pharmacy records) to monitor safety after approval

- Streamlining fees for small businesses

- Clearer rules on affiliated companies

The Congressional Budget Office says GDUFA is one of the most cost-effective programs the FDA runs. For every $1 the government spends on generic reviews, $1.20 comes in from user fees. That’s a return most government programs would kill for.

As long as the system stays transparent, fair, and focused on speed without sacrificing safety, GDUFA will keep doing what it was built for: making sure no one has to choose between their health and their wallet.

Do generic drug fees speed up approval?

No. Fees don’t guarantee approval or fast-track applications. They fund the FDA’s review capacity, allowing more staff, better tools, and clearer timelines. The approval decision is still based entirely on scientific and regulatory standards, not payment.

Who pays GDUFA fees?

Generic drug manufacturers pay all GDUFA fees. This includes fees for submitting applications (ANDAs), maintaining approved products (program fees), operating manufacturing facilities (facility fees), and submitting ingredient data (DMF fees). The fees are required before the FDA will review any application.

Are GDUFA fees the same every year?

No. Fees are adjusted annually based on inflation and program needs. For example, the FY 2023 application fee was $124,680, but it was lower in previous years and may change again in FY 2024. The FDA publishes updated fee schedules each year.

Can small companies get help with GDUFA fees?

Yes. Small businesses that meet specific criteria-like having fewer than 500 employees and fewer than three approved generic drugs-can apply for a 75% reduction on most fees. However, very few apply: only 18 small business fee reductions were processed in FY 2022, suggesting many companies don’t know they qualify.

Why doesn’t GDUFA cover over-the-counter (OTC) drugs?

GDUFA was designed specifically for prescription generic drugs. OTC drugs operate under older, separate rules called monograph systems. There’s growing pressure to bring OTCs under GDUFA to modernize their review process, but no legislative action has been taken yet. Including them could generate $150-200 million annually in new fees.